State Taxes

Call Now

+1 (888) 509 0605Latest Services

Tax planning and management consultancy

April 2, 2025Customize Financial Solution

April 2, 2025Federal taxes

April 2, 2025If You Need Any Help Contact With Us

State Tax Compliance and Advisory Services

As a growing business, managing free state tax filing obligations across multiple jurisdictions can be complex. Our team of tax experts is here to help you stay compliant with state tax laws in every state where you operate. We simplify the filing process, ensuring accurate submissions and minimizing the risk of penalties, so you can focus on scaling your business with confidence.

State Tax Filing Made Easy

State tax filing services to ensure compliance and maximize your refund. Get expert assistance in just 3 easy steps!

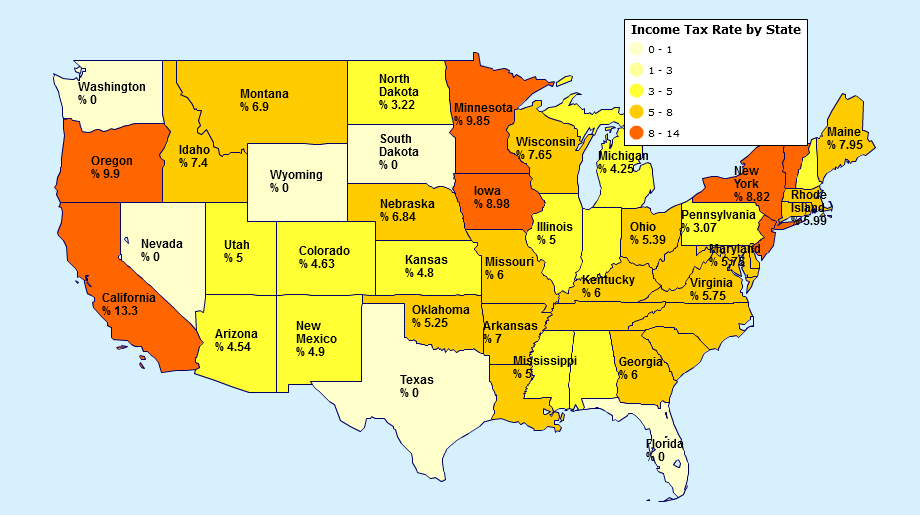

Key Facts on State Taxes

Income earned in a state is taxable by that state, even if you reside elsewhere. Hence, you must file returns and pay applicable taxes in every state where you conduct business. It’s worth noting that state tax laws differ in terms of rates, deductions, forms, and filing dates, making it essential to have the right guidance.

When an unknown printer took a galley of type and scrambled it to make a type specimen bookhas survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchan galley of type and scrambled it to make a type specimen book.

Our States Taxes Service

At our State Tax Services, we offer a range of services to help you navigate state tax compliance. These include:

- Multi-state tax return preparation and filing

- Researching state tax codes to minimize liability

- Guidance on state-specific requirements and forms

- Estimated payment calculation and reminders

- Audit support if questions or issues arise

- Advisory on setting up additional nexus presences

- Notifications on state tax law changes

Custom Tax Solutions

Planning, compliance, technology, and consulting – our customized tax services boost profitability through strategic management. Access integrated guidance focused on your success.